rusabc.ru

Community

How Do Brokers Make Their Money

1. They earn off commissions. 2. They earn by trading against their clients. e.g. If you're a small account or regularly losing etc, they. There are two ways to make money as a realtor: working with buyers (buyer agents) or sellers (listing agents). 1. Buyer agent. If you choose to be a real estate. Trading brokers, on the other hand, tend to make their money from the spread, as well as commissions, overnight funding and other fees. More ways to make that money. When you start out, leasing is a great option. · BOVs. Many banks will pay anywhere from $$1,+ for brokers to do an opinion. IBs receive commissions or discounts for their work. This is typically paid by affiliated brokerages and trading platforms through commissions earned from. More ways to make that money. When you start out, leasing is a great option. · BOVs. Many banks will pay anywhere from $$1,+ for brokers to do an opinion. Brokerages primarily earn money through brokerage charges and transaction fees from clients rather than direct profits or losses based on client. Flat fees. This is yet another way business brokers charge for their services. This option is considered when the sale is not a high-value transaction. When. Brokers earn a percentage of the commission earned by the agents they sponsor or % of the commission from their own deals. 1. They earn off commissions. 2. They earn by trading against their clients. e.g. If you're a small account or regularly losing etc, they. There are two ways to make money as a realtor: working with buyers (buyer agents) or sellers (listing agents). 1. Buyer agent. If you choose to be a real estate. Trading brokers, on the other hand, tend to make their money from the spread, as well as commissions, overnight funding and other fees. More ways to make that money. When you start out, leasing is a great option. · BOVs. Many banks will pay anywhere from $$1,+ for brokers to do an opinion. IBs receive commissions or discounts for their work. This is typically paid by affiliated brokerages and trading platforms through commissions earned from. More ways to make that money. When you start out, leasing is a great option. · BOVs. Many banks will pay anywhere from $$1,+ for brokers to do an opinion. Brokerages primarily earn money through brokerage charges and transaction fees from clients rather than direct profits or losses based on client. Flat fees. This is yet another way business brokers charge for their services. This option is considered when the sale is not a high-value transaction. When. Brokers earn a percentage of the commission earned by the agents they sponsor or % of the commission from their own deals.

Freight brokers make their money in the margin between the amount they charge each shipper (their customer) and what they pay the carrier (the truck driver). Non-market maker forex brokers can make money in three different ways: via spread or via commissions or through a combination of the two. If you are new and. How do stock brokerage fees work? Stock brokerage fees are typically a commission that a broker charges for executing trades on behalf of their clients. These. Your mortgage broker must declare how much, if anything, they'll earn from the lender. Brokers are regulated by the Financial Conduct Authority (FCA), so they. Zero-commission brokers would have agreements to direct their customer trade orders to specific providers in exchange for a commission/fee based on volume. Data brokers, a silent workforce behind the scenes gathering data for companies, organizations, and other groups. Their income is based on the information they. The broker makes money because the prices it trades with its liquidity providers (LPs) are better than the prices it trades with its customers. The markup is. A typical broker accepts and carries out orders to buy and sell investments. It also may make recommendations to buy, sell or hold a specific investment. How much money do Auto Brokers make? Typically, Auto Brokers earn a commission (not a salary) from the dealership for each vehicle they sell or lease. The. Insurance brokers bridge the gap between clients and fitting insurance policies. · Their earnings primarily stem from commissions and broker fees, both. One way brokers earn money is to charge commissions that are a percentage of the value of the brokered deal. This is a favorite of real estate brokers, where. Trading against the trader. The most despised and unethical way a Forex broker can make money is to trade against its customers. And that is the most profitable. There are a few ways that insurance brokers can make money. The two main ways are by commission and by fees, and then the third way is by profit sharing. Mortgage brokers make the bulk of their income based on commissions from the lenders they work with. As a mortgage broker, you will be earning two kinds of. Forex brokers earn their income mainly through two methods: commissions per trade or spreads. Understanding spreads is key. This involves lending money to hedge funds to help them cover their trading positions and meet their margin requirements. Prime brokers charge interest on these. A typical broker accepts and carries out orders to buy and sell investments. It also may make recommendations to buy, sell or hold a specific investment. Most auto brokers earn a commission for the vehicle they sell or lease. The commission can range from a few hundred dollars for a lower-priced vehicle to. How Do Brokers Make Money? Brokers typically make money through commissions or fees on the services they render. A common example of this is the structure for.

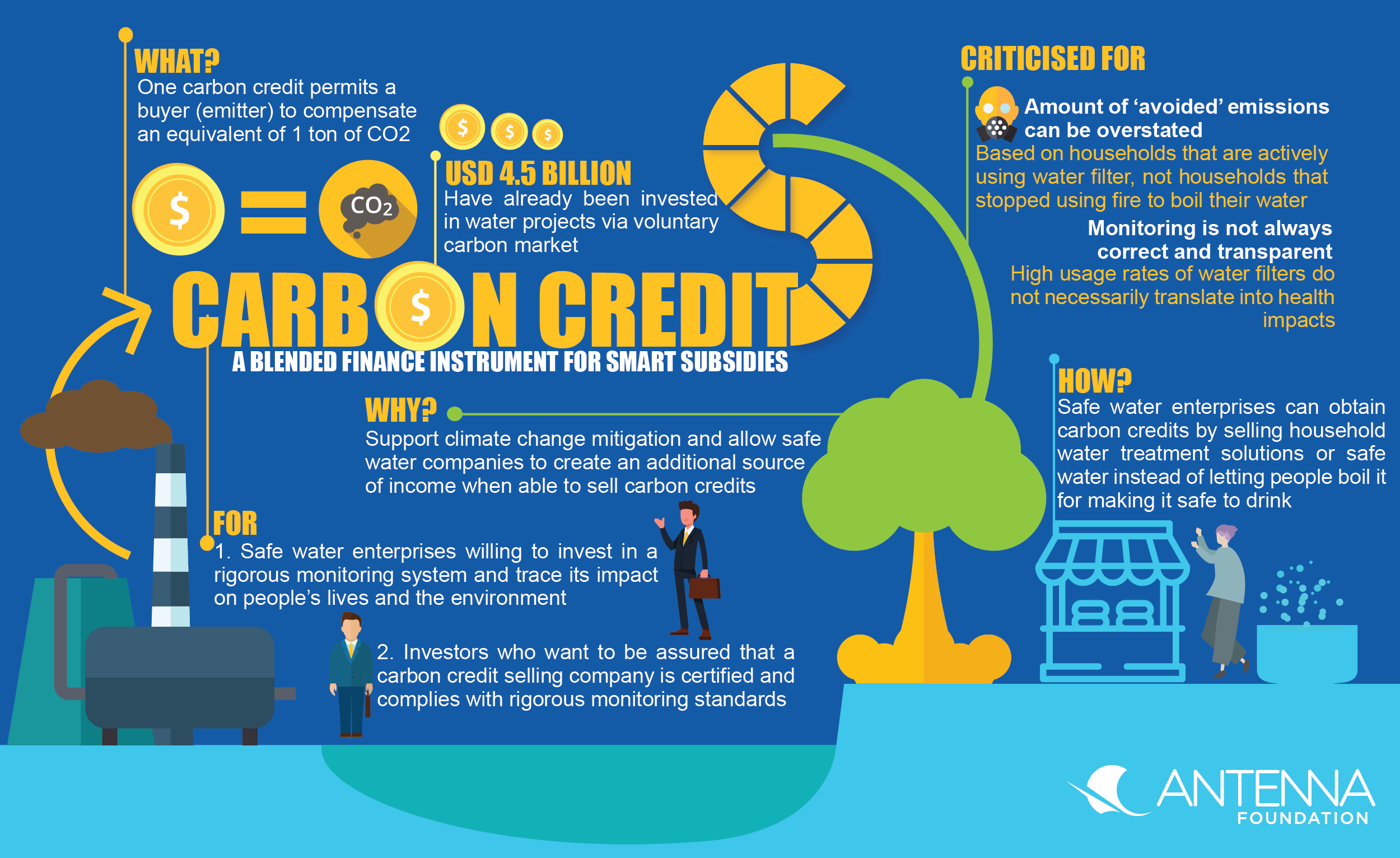

Companies Selling Carbon Credits

If the company can issue a carbon offset for each ton of CO2 its new technology keeps out of the air, selling these offsets may help finance the investment. Why Carbon Markets? Individuals, companies, or organizations often cannot, in the short term, completely reduce their GHG emissions. Buying credits on the. Take your sustainable project to the next level by uploading it for free on the world's first climate marketplace, reaching millions of users and companies. We develop rigorous standards, methodologies and tools for greenhouse gas accounting. We only register project-based carbon credits that are real. Under a cap and trade system, companies are allotted a certain number of credits that limit how much carbon dioxide they can emit (the cap): 1 carbon credit. If a management team is able to limit company emissions below its cap, then the organization has a surplus of carbon credits; they may wish to retain these for. If the company can issue a carbon offset for each ton of CO2 its new technology keeps out of the air, selling these offsets may help finance the investment. Best trading company, Numerco, SCB Group/Viridios Capital ; Best advisory/consultancy, ClearBlue Markets, Virdios Capital ; Best Law firm, Philip Lee, Holman. Professional carbon credit traders purchase and sell They provide a convenient way for consumers and businesses to access carbon credits from a portfolio of. If the company can issue a carbon offset for each ton of CO2 its new technology keeps out of the air, selling these offsets may help finance the investment. Why Carbon Markets? Individuals, companies, or organizations often cannot, in the short term, completely reduce their GHG emissions. Buying credits on the. Take your sustainable project to the next level by uploading it for free on the world's first climate marketplace, reaching millions of users and companies. We develop rigorous standards, methodologies and tools for greenhouse gas accounting. We only register project-based carbon credits that are real. Under a cap and trade system, companies are allotted a certain number of credits that limit how much carbon dioxide they can emit (the cap): 1 carbon credit. If a management team is able to limit company emissions below its cap, then the organization has a surplus of carbon credits; they may wish to retain these for. If the company can issue a carbon offset for each ton of CO2 its new technology keeps out of the air, selling these offsets may help finance the investment. Best trading company, Numerco, SCB Group/Viridios Capital ; Best advisory/consultancy, ClearBlue Markets, Virdios Capital ; Best Law firm, Philip Lee, Holman. Professional carbon credit traders purchase and sell They provide a convenient way for consumers and businesses to access carbon credits from a portfolio of.

Carbon Trade eXchange (CTX) is the world's first digital carbon offsetting exchange for spot price, voluntary carbon credit trading. The purchaser of a carbon credit certificate or permit has the right to emit 1-ton of carbon dioxide or some other recognized greenhouse gas. Some companies. South Pole — One of the biggest players primarily addressing companies. They are also selling carbon offsets to individuals and have an. If the organization produces fewer tons of carbon emissions than it is allocated, the organization can trade, sell or hold the remaining carbon credits. When a. Through the offset credit component of Québec's carbon market, individuals and companies They may then sell these credits to companies regulated by the carbon. Offset Suppliers ; Carbon Credit Capital, rusabc.ru, New York City, NY ; Carbon Fund, rusabc.ru, East Aurora, NY ; Clear Sky Climate. Voluntary carbon markets provide a means where companies or individuals can purchase carbon credits merely for the sake of offsetting GHG emissions. When an entity invests in a carbon offsetting program, it receives carbon credit or offset credit, which account for the net climate benefits that one entity. To sell carbon credits a company must get a third-party auditor to verify the validity of their emissions reductions. · Carbon credit prices vary from market to. The UN Carbon Offset Platform is an e-commerce platform where a company, an organization or a regular citizen can purchase units (carbon credits) to compensate. Carbon removal marketplaces are the bridge between companies that sell the removals of CO2 carbon credits to bringing them to market. 4. Supercritical. ENGIE Impact helps clients navigate rapidly changing market conditions, identify carbon projects that support their unique sustainability story, and secure high. The impacts of climate change are already being felt around the world and the clock is ticking to keep global warming to safe levels. Companies must. A commonly used purchasing option is to contract directly with a project developer for delivery of carbon offset credits as they are issued. Such contracts. Carbonplace is the only carbon market solution powered by the world's leading banks. The platform fundamentally transforms how carbon credits are transacted. Selling carbon credits Our long-term relationship with corporate clients means we know their offsetting needs today, and into the future. This helps us. Carbon credits are generated by projects that have avoided or removed greenhouse gas emissions. Each credit represents one less tonne of carbon dioxide. These are third-party companies that assist with the up-front and ongoing costs of the project and sell the carbon credits on a registry in exchange for a share. Professional carbon credit traders purchase and sell avoided emissions or enhanced removals by taking advantage of market price distortions and arbitrage. Slowing climate change by reducing greenhouse gas emissions; Creating a “carbon market” that allows companies to buy and sell credits. Holistic suite of.

What Credit Do You Need For Walmart Credit Card

which credit card I want to replace the Walmart card. I'm seriously If you do not want the quicksilver card, you should be able to. A Walmart MoneyCard account does not offer a line of credit like credit cards do, which means you'll need to add money to your account before you can use. You can also save with a reloadable prepaid MasterCard or Visa Walmart MoneyCard. Use these reloadable prepaid cards like a debit card and enjoy cash back. My card is not working; the transaction is not going through, what should I do? The general target audience for the Walmart credit card is Walmart shoppers with good or excellent credit scores. Customers with little or no credit may be. But it isn't limited to Walmart usage, you can swipe it anywhere Visa or Mastercard are accepted. The best part for many customers is that you don't have to. ALWAYS call your new credit card bank and ask them when they close your billing cycle. If you pay it in full every month, then this is the date you want to do. There is no credit check with a Walmart MoneyCard and we do not report your account to any credit bureau. Was this answer helpful?*. The Walmart Rewards Card is best for people who do most of their shopping at Walmart, who visit Walmart-branded gas stations for fuel, and who aren't looking. which credit card I want to replace the Walmart card. I'm seriously If you do not want the quicksilver card, you should be able to. A Walmart MoneyCard account does not offer a line of credit like credit cards do, which means you'll need to add money to your account before you can use. You can also save with a reloadable prepaid MasterCard or Visa Walmart MoneyCard. Use these reloadable prepaid cards like a debit card and enjoy cash back. My card is not working; the transaction is not going through, what should I do? The general target audience for the Walmart credit card is Walmart shoppers with good or excellent credit scores. Customers with little or no credit may be. But it isn't limited to Walmart usage, you can swipe it anywhere Visa or Mastercard are accepted. The best part for many customers is that you don't have to. ALWAYS call your new credit card bank and ask them when they close your billing cycle. If you pay it in full every month, then this is the date you want to do. There is no credit check with a Walmart MoneyCard and we do not report your account to any credit bureau. Was this answer helpful?*. The Walmart Rewards Card is best for people who do most of their shopping at Walmart, who visit Walmart-branded gas stations for fuel, and who aren't looking.

Walmart Pay can use credit, debit or gift cards saved to your Walmart account. You should hear a chime and see a confirmation. We'll send a notification. You. A Walmart MoneyCard account does not offer a line of credit like credit cards do, which means you'll need to add money to your account before you can use. The retail behemoth and its credit card issuer said in a terse, joint press release Friday that they're parting ways. Published May 24, We know that it can be frustrating trying to apply for a new credit card when you have bad credit. do and not do as you approach the credit application. Manage your account and redeem your Walmart credit card rewards. You have to have steady income and a good record of paying your bills. Not having excessive debt helps also. you should be able to find nearly everything you need to run your business. A business credit builder card is a credit card designed to help you improve your. Pros & Cons of Walmart credit card · Higher than average purchase APRs. · You need good credit to qualify. · Does not offer a signup bonus. · Charges a balance. It cannot be used for online purchases at rusabc.ru, for purchases on the Sam's Club app or purchases from in-store vendors. How Do You Determine My Credit. The Walmart Credit Card requirements for approval include: Being 18+ years old. Having a credit score of at least (fair credit). A monthly income that's at. you use your card with Walmart Pay. Reward Rates: N/AN/A: N/AN/A: N/AN/A: N/AN you can review the credit card terms and conditions on the issuer's web site. Credit cards; Pay by bank; Gift cards (Note: you cannot use a gift card to purchase another gift card); Refund credit; Capital One Walmart Credit. If Walmart should happen to create a new credit card program in any way, you will have to apply for a new account the same way you would with. Case-sensitive, may differ from your rusabc.ru User ID. Password. Show. Remember User ID (Optional). Secure Login. I forgot myUser IDorPassword. I want to. Here's a Summary of the Best Credit Cards for Walmart. Once you apply for the Capital One® Walmart Rewards™ Mastercard®, Capital One will automatically consider you for the Walmart Rewards® Card if your credit isn't. THINGS YOU SHOULD KNOW ABOUT THIS CARD. How Do You Calculate My Variable We may honor transactions above your credit limits, but if we do these. While the Capital One Walmart Rewards Mastercard is a credit card that allows you The Credit Cards You Should Have And Why. Capital One Walmart Rewards. THINGS YOU SHOULD KNOW ABOUT THIS CARD. How Do You Calculate My Variable We may honor transactions above your credit limits, but if we do these. Synchrony Financial and Green Dot Introduce Cash-Back Rewards for. The Walmart Credit Card and Walmart MoneyCard Programs · [i] Synchrony Bank is a.

The Best Crypto To Invest In 2021

Cryptocurrency exchanges such as Coinbase (COIN %) make it fairly easy to buy and sell crypto assets such as Bitcoin (BTC %) and Ethereum (ETH %), but. Investing News Network. May 03, Technology This is according to crypto expert Mitchell Koulouris, who has referred to the pandemic as “the perfect storm” for Bitcoin and other crypto currencies. Bitcoin is ideal for beginners or those looking for a low-maintenance investment. It's widely available on exchanges and accepted by many services for payments. Overall, Binance tops the list for the highest valuation of a crypto company at $ billion, followed by Coinbase at $ billion and Robinhood at $39 billion. Bitcoin (BTC)- Bitcoin, launched in by Satoshi Nakamoto is not only the trendsetter in the crypto world but also the best and most popular. · Ethereum. Here are resources to help you better understand Bitcoin, cryptocurrencies November Investing in Crypto Progress. Leads $50M raise for Cadenza. 1. Helium (HNT-USD) · 2. Chainlink (LINK) · 3. BitTorrent (BTT) · 4. Ocean Protocol (OCEAN) · 5. Kusama (KSM-USD) · 6. Theta network (THETA). Bitcoin, ETH & Solana: Top 3 coin according to Market cap are probably the best to buy & hodl at the moment for the long term. Top Cryptocurrency To Invest In December By Recent Growth ; Solana. SOL. 13, ; Polygon. MATIC. 8, ; Terra. LUNA. 6, Cryptocurrency exchanges such as Coinbase (COIN %) make it fairly easy to buy and sell crypto assets such as Bitcoin (BTC %) and Ethereum (ETH %), but. Investing News Network. May 03, Technology This is according to crypto expert Mitchell Koulouris, who has referred to the pandemic as “the perfect storm” for Bitcoin and other crypto currencies. Bitcoin is ideal for beginners or those looking for a low-maintenance investment. It's widely available on exchanges and accepted by many services for payments. Overall, Binance tops the list for the highest valuation of a crypto company at $ billion, followed by Coinbase at $ billion and Robinhood at $39 billion. Bitcoin (BTC)- Bitcoin, launched in by Satoshi Nakamoto is not only the trendsetter in the crypto world but also the best and most popular. · Ethereum. Here are resources to help you better understand Bitcoin, cryptocurrencies November Investing in Crypto Progress. Leads $50M raise for Cadenza. 1. Helium (HNT-USD) · 2. Chainlink (LINK) · 3. BitTorrent (BTT) · 4. Ocean Protocol (OCEAN) · 5. Kusama (KSM-USD) · 6. Theta network (THETA). Bitcoin, ETH & Solana: Top 3 coin according to Market cap are probably the best to buy & hodl at the moment for the long term. Top Cryptocurrency To Invest In December By Recent Growth ; Solana. SOL. 13, ; Polygon. MATIC. 8, ; Terra. LUNA. 6,

Singapore has taken the top spot thanks to a booming crypto economy, positive legislation, and the world's second highest percentage of crypto-owning population. Quant funds trading liquid exchange-listed crypto assets can provide better liquidity in relation to investments in early-stage projects or multi-strategy funds. Thanks for all your feedback. I realized that this point The Best Months to Invest in Bitcoin. Historically, July, October. 6 of the Best Cryptocurrencies to Buy Now · Bitcoin (BTC) · Ether (ETH) · Solana (SOL) · Avalanche (AVAX) · Pepe (PEPE) · Cardano (ADA). 1. Ethereum (ETH) · 2. Tether (USDT) · 3. XRP · 4. Binance Coin (BNB) · 5. USD Coin (USDC) · 6. Cardano (ADA) · 7. Solana (SOL) · 8. Dogecoin (DOGE). Bitcoin, ETH & Solana: Top 3 coin according to Market cap are probably the best to buy & hodl at the moment for the long term. Coinbase is a secure online platform for buying, selling, transferring, and storing cryptocurrency. Best Crypto To Buy Now · 1. Bitcoin (BTC) · 2. Ethereum (ETH) · 3. Tether (USDT) · 4. Binance Coin (BNB) · 5. Solana (SOL) · 6. U.S. Dollar Coin (USDC) · 7. XRP (XRP). If you're thinking of investing in Bitcoin, be sure to research the best cryptocurrency exchanges and apps first. In mid-December , Bitcoin fell to a. Cryptoassets as National Currency? A Step Too Far. Tobias Adrian, Rhoda Weeks-Brown. July 26, عربي, 中文, Español, Français, 日本語, Português. Cryptocurrency exchanges such as Coinbase (COIN %) make it fairly easy to buy and sell crypto assets such as Bitcoin (BTC %) and Ethereum (ETH %), but. If you believe in blockchain technology, cryptocurrency is a great long-term investment. Bitcoin is seen as a store of value, and some people. Decentralized apps: Ethereum is the biggest blockchain for decentralized applications and NFTs! Many investors see buying ETH as a bet on Web3 and a. In November , the price of bitcoin surged to more than $60, for “If you buy crypto-assets and the price goes to zero at some point, please. investment. This is puzzling. It has no Representations of the Bitcoin cryptocurrency are seen in this illustration picture taken June 7, In , we saw Bitcoin gaining almost $40,, and Shiba Inu proved to be more than just another meme coin. But the great and vast world of cryptocurrencies is. a better store of value, but crypto also As of December , the peak trading price of Bitcoin was in November when its value reached £51, At Square we believe there's a high probability that the internet will have its own native cryptocurrency, and Bitcoin is the strongest contender. It's the most. Most probably know Dogecoin because of its huge spike, but the coin has been around since This coin was originally intended as a joke, but it has. A cryptocurrency, crypto-currency, or crypto is a digital currency designed to work as a medium of exchange through a computer network that is not reliant.

Overhead Door Installation Cost

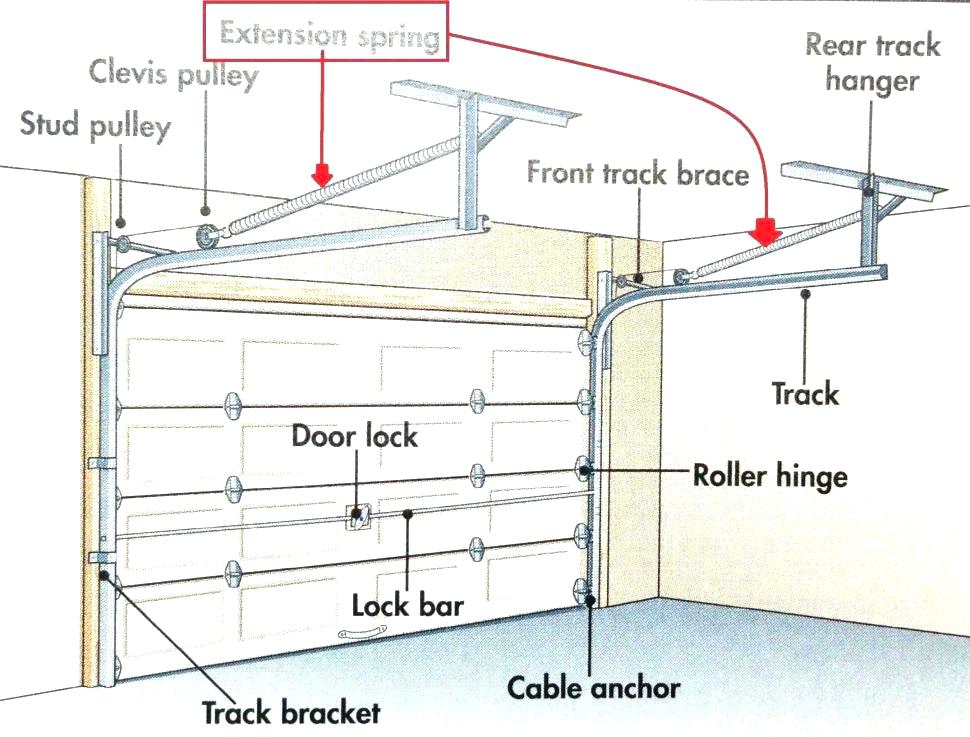

Overhead Garage Door prices start at about $ for a single, standard door and range up to about $6, for a premium door. That's a wide price range, but it. We have done a little research to find the average cost of garage door installation in South Bend. Here are the average costs and prices reported back to us. Home Depot charges $ per opener for installation and openers are $$ garage door is $ to $ Two Layer Steel Garage Doors: $ to $1, The dual layer steel garage door is the middle grade option providing a layer of. When you are looking at replacement garage door installation, there are more things to consider than just the cost. Curb appeal is something to think about. The cost of installation for a basic single car garage door ranges from $ to $1, Generally, the price goes up with difficulty, so if your garage door. The cost of hiring a garage door installer for a small garage door varies from $ to $2, The cost of labor for installing a medium-sized garage door. Commercial Overhead Door Models /, / ; Model, Size WxH, Number of panels across, Overhead Door System without windows, Overhead Door with Square. Average cost to install an overhead garage door is about $ (8' garage door and hardware). Find here detailed information about overhead garage door. Overhead Garage Door prices start at about $ for a single, standard door and range up to about $6, for a premium door. That's a wide price range, but it. We have done a little research to find the average cost of garage door installation in South Bend. Here are the average costs and prices reported back to us. Home Depot charges $ per opener for installation and openers are $$ garage door is $ to $ Two Layer Steel Garage Doors: $ to $1, The dual layer steel garage door is the middle grade option providing a layer of. When you are looking at replacement garage door installation, there are more things to consider than just the cost. Curb appeal is something to think about. The cost of installation for a basic single car garage door ranges from $ to $1, Generally, the price goes up with difficulty, so if your garage door. The cost of hiring a garage door installer for a small garage door varies from $ to $2, The cost of labor for installing a medium-sized garage door. Commercial Overhead Door Models /, / ; Model, Size WxH, Number of panels across, Overhead Door System without windows, Overhead Door with Square. Average cost to install an overhead garage door is about $ (8' garage door and hardware). Find here detailed information about overhead garage door.

A 16×7 25 gauge garage door is $ plus tax installed and a 24 gauge is $ plus tax installed. An 8×7 25 gauge garage door is $ plus tax installed. A single basic garage door cost can vary between $$ and a basic double garage door may be between $$ The cost of labor can be from $$ per. Installing a garage door is considered a medium-difficult do-it-yourself project for a two-person team, at an average cost of $$, depending on the type. Including labor costs, most standard-sized PVC speed doors will cost between $ to buy and install. Metal. High Speed Garage Door. Crafted from steel or. Replacing the entire door, frame and hinges with a new opener could run between $1k max, depending upon the size of the garage, the size of. The installation price varies from the type of door, where it is being installed, etc. The Overhead Door Company of Savannah™ likes to do installation service. Garage Door Panel Replacement Cost. If you have a newer garage door, then this replacement can cost around $. If you have an older garage door, then the. The cost to install a single garage door is around $ to $ for the labor, and $ to $1, in total. They can come in many different shapes, sizes, and. Affordable Garage Door Installation Cost. A standard insulated white double car garage door with installation starts at $ That includes removal and. How much does the installation of a commercial or industrial garage door cost? Trying to estimate a price for budget purposes is difficult because there are. The basic cost to Install Steel Garage Door is $ - $ per door in April , but can vary significantly with site conditions and options. As you would expect, manual garage doors are cheaper to install. The average cost to install a manual garage door is $ to $2,, according to HomeAdvisor. Roll Up Doors Direct offers high quality roll up doors for both commercial and residential use. We have many different models to fit any application. 9x7 garage door start at around $ and 16x7 are starting at $ nonetheless be aware that several elements control the price of the garage door. The size. Cost vs. Value Report. Case Study. before and after carbon oak garage doors installation. Garage Door Replacement: Over % Return on Investment. Garage door. The most basic, non-insulated single garage doors start at around $ when installed, while double doors start at approximately $ when installed. price in a variety of styles. Learn More · Residential garage door Our builder scheduled Overhead Door Company to install a new garage door opener. Cost of installing an 9×7 garage door. The price to install a 9×7 steel conventional garage door is as follows: Garage door 9×7 Cost of installation: non-. Homeowners can expect to pay about $ to $1, for a standard, single garage door and $ to $1, for a double car door. Having said that, the total cost. Home | Custom Installation Services | Garage Doors. Price. Less than $25 (3) results After selecting page will be reloaded. Customer Reviews. 2 stars & Up.

How To Find The 200 Day Moving Average

DMA in the stock market stands for Day Moving Average. In technical analysis, moving averages can help determine security's entry and exit points. It compares a. Michael Mack, Portfolio Manager. Investors have long used moving averages to determine trends in the market. Generally, when an index or a security is above. A day moving average is a line on the chart-graph over the last days. Angel One's guide will help you to understand the day moving average chart. For example, at any given point in time, a period Moving Average plots the average price over the past periods. On a daily chart, the period Moving. In bull markets, the day moving average is pretty useless. But during extended corrections like this one, it's an invaluable indicator. The day moving average is a way for traders and investors to find out about trends in the market. This is important while investing and trading in the. An SMA is calculated by adding all the data for a specific time period and dividing the total by the number of days. If XYZ stock closed at 30, 31, 30, 29, and. To calculate the Simple Moving Average, add together the closing prices of a security over a set period of days and then divide by the number of days in the. I'm new at this, someone suggested Trading View, and it looks amazing! I picked a stock, chose Moving Average from the indicators button. DMA in the stock market stands for Day Moving Average. In technical analysis, moving averages can help determine security's entry and exit points. It compares a. Michael Mack, Portfolio Manager. Investors have long used moving averages to determine trends in the market. Generally, when an index or a security is above. A day moving average is a line on the chart-graph over the last days. Angel One's guide will help you to understand the day moving average chart. For example, at any given point in time, a period Moving Average plots the average price over the past periods. On a daily chart, the period Moving. In bull markets, the day moving average is pretty useless. But during extended corrections like this one, it's an invaluable indicator. The day moving average is a way for traders and investors to find out about trends in the market. This is important while investing and trading in the. An SMA is calculated by adding all the data for a specific time period and dividing the total by the number of days. If XYZ stock closed at 30, 31, 30, 29, and. To calculate the Simple Moving Average, add together the closing prices of a security over a set period of days and then divide by the number of days in the. I'm new at this, someone suggested Trading View, and it looks amazing! I picked a stock, chose Moving Average from the indicators button.

Technical Analysis Summary for S&P Index with Moving Average, Stochastics, MACD, RSI, Average Volume Day, 5,, +1,, +%, 0. Year-to. The day moving average is used by both technical and fundamental investors to obtain insight into the long-term price trend of the stock/etf/index. You always need the number of days data before you can calculate that day's Average! So if you want the day SMA for a particular day you need days of. Day, 5,, +1,, +%, 0. Year-to-Date, 5,, +, + calculated against the 3-Day Moving Average). The Relative Strength Index. A Day moving average is calculated by taking the closing prices for the last days of any security, summing them together and dividing by These scans are all based on either the 20, 50 or day moving averages (DMAs). Possible price reversals may be indicated by support or resistance at a given. / period: The same holds true for the moving average. The period moving average is popular on the daily chart since it describes one year of. Simple moving average (SMA). An SMA is calculated by adding all the data for a specific time period and dividing the total by the number of days. If XYZ stock. Moving Averages · Candlestick Patterns · Cannabis Stocks · Cathie Wood Stocks find out more and change our default settings. However, blocking some types. Simple moving averages give equal weight to each daily price. For example, to calculate a day moving average of IBM: First, you would add IBM's closing. How to Calculate the Simple Moving Average. SMA takes a certain number of days (periods) when calculating its value. You can adjust these periods, changing the. On desktop app, open your chart (in Stocks or Customized tab), click on Indicators, then Edit. Highlight and check MA or EMA (use whichever you prefer). The day moving average is a stock's average closing price over the last 40 weeks. It's a standard tool for gauging the broader direction of the stock. Use a moving average that is roughly half the length of the cycle that you are tracking. If the peak-to-peak cycle length is roughly days (1 year) then a. You sell if price is trading above the day moving average with the moving average as take profit target and buy if price is trading below the average with. To find the 50 day moving average, you would add up the closing prices (but not always, we'll explain later) from the past 50 days and divide them by The day moving average is a stock's average closing price over the last 40 weeks. It's a standard tool for gauging the broader direction of the stock. The day simple moving average is just a long-term moving average and is widely used in conjunction with other shorter-term moving averages to highlight and. A simple moving average is the sum of the prices over a period of time divided by that time period. For example, a "20 day Moving Average" is the sum of the. The formula for this list is absolute_value(50 day SMA of the closing prices - day SMA of the closing prices) / volatility. The smallest value is shown at.

Frx Stock

Forest Road Acquisition Corp Cl A stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. TradingView India. View live FENNEC PHARMACEUTICALS INC chart to track its stock's price action. Find market predictions, FRX financials and market news. 20 minutes ago. Learn how to trade big board and penny stocks by learning to read stock charts and identify technical patterns through technical analysis. Range, Low Price, High Price, Comment. 30 days, $, $, Wednesday, 8th Dec FRX stock ended at $ During the day the stock fluctuated 0%. FRX stock is % volatile and has beta coefficient of Track FLEXIROAM LIMITED stock price on the chart and check out the list of the most volatile. Stock analysis for Beachbody Co Inc/The (FRX:US) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Get FLEXIROAM Ltd (FRX:ASX) real-time stock quotes, news, price and financial information from CNBC. Fennec Pharmaceuticals Inc. ; Volume, K ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), Forest Road Acquisition Corp Cl A stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. TradingView India. View live FENNEC PHARMACEUTICALS INC chart to track its stock's price action. Find market predictions, FRX financials and market news. 20 minutes ago. Learn how to trade big board and penny stocks by learning to read stock charts and identify technical patterns through technical analysis. Range, Low Price, High Price, Comment. 30 days, $, $, Wednesday, 8th Dec FRX stock ended at $ During the day the stock fluctuated 0%. FRX stock is % volatile and has beta coefficient of Track FLEXIROAM LIMITED stock price on the chart and check out the list of the most volatile. Stock analysis for Beachbody Co Inc/The (FRX:US) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Get FLEXIROAM Ltd (FRX:ASX) real-time stock quotes, news, price and financial information from CNBC. Fennec Pharmaceuticals Inc. ; Volume, K ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM),

Get the latest stock price for FRX Innovations Inc. (FRXI), plus the latest news, recent trades, charting, insider activity, and analyst ratings. How to buy FRX stock on Public · 1. Sign up for a brokerage account on Public. It's easy to get started. · 2. Add funds to your Public account · 3. Choose how. Stock Target Advisor runs millions of automatic calculations on over 75, stocks in American, Asian and European Exchanges and compares it with market analyst. Forest Road Acquisition Corp. (FRX) - Stock Splits. Stock symbol FRX is outdated, potentially delisted? Maybe it is available on other exchange? Stock splits. In the current month, FRX has received 12 Buy Ratings, 0 Hold Ratings, and 0 Sell Ratings. FRX average Analyst price target in the past 3 months is C$ The Stock Price Chart contained here is smoothed, and does not include any of the technical indicators that we offer our subscribers. Price action tells us. FRX (ZB_NYSE): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock FRX | Nyse: | Nyse. Fennec Pharmaceuticals (FRX) has a Smart Score of 4 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom. Key Stock Data · P/E Ratio (TTM). N/A · EPS (TTM). $ · Market Cap. $ M · Shares Outstanding. M · Public Float. N/A · Yield. FRXIF is not. Research Flexiroam's (ASX:FRX) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and more. Get Fennec Pharmaceuticals Inc (rusabc.ru) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Get Fennec Pharmaceuticals Inc (FRX-CA:Toronto Stock Exchange) real-time stock quotes, news, price and financial information from CNBC. Fennec Pharmaceuticals Inc. advanced stock charts by MarketWatch. View FRX historial stock data and compare to other stocks and exchanges. Should You Buy or Sell Forest Road Acquisition Stock? Get The Latest FRX Stock Analysis, Price Target, Headlines, Short Interest at MarketBeat. Stock analysis for Fennec Pharmaceuticals Inc (FRX:Toronto) including stock price, stock chart, company news, key statistics, fundamentals and company. Get the latest Fennec Pharmaceuticals Inc (FRX) real-time quote, historical performance, charts, and other financial information to help you make more. Complete Flexiroam Ltd. stock information by Barron's. View real-time FRX stock price and news, along with industry-best analysis. Click here to see Beachbody Company Inc (the) - Ordinary Shares - Class A. Option back testing and analysis. Run your backtest on (FRX) dips and trigger. Research Fennec Pharmaceuticals' (TSX:FRX) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance. View Flexiroam Ltd (FRX) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Trade commission-free with the.

How Much Does It Cost To Get Dog Dna Tested

The GenoPet is Orivet's latest dog DNA test, and is priced at $99 on Amazon. Why we like it: Orivet is a quality test for a reasonable price. Orivet's. In addition, we are offering our clients the opportunity to purchase a premium package priced at $ including 3 Dog tests, the Dog Genetic Age test, Breed. Home DNA tests for dogs can range from $68 to $, depending on the test's comprehensiveness. These tests provide valuable insights into your dog's breed. The average costs of a dog DNA test are between $40 and $ These are the fees charged if the DNA test is performed at a vet clinic. There are also DNA test. How Much Does a Dog Breed DNA Test Cost? Dog DNA tests can cost you anywhere from around sixty to a few hundred dollars. The more expensive tests typically. Starting from only $ and with results in 3 weeks from receipt of samples at the laboratory, dog breed identification testing checks for 1, genetic markers. Same - for all 3 of the dogs I've had & tested! They cost a grand total of $ ($50, $, and free), while the tests were $ each. Price. $ Sale Price: $ $ Sale Price: $ ; Complete breed breakdown. Identification of + breeds. ; Genetic health concerns. Discover. Breed ID Test · $ · $ ; Breed + Health Test · $ · $ ; Breed + Health Test 2-pack · $ · $ ; Breed ID Test 2-pack · $ · $ The GenoPet is Orivet's latest dog DNA test, and is priced at $99 on Amazon. Why we like it: Orivet is a quality test for a reasonable price. Orivet's. In addition, we are offering our clients the opportunity to purchase a premium package priced at $ including 3 Dog tests, the Dog Genetic Age test, Breed. Home DNA tests for dogs can range from $68 to $, depending on the test's comprehensiveness. These tests provide valuable insights into your dog's breed. The average costs of a dog DNA test are between $40 and $ These are the fees charged if the DNA test is performed at a vet clinic. There are also DNA test. How Much Does a Dog Breed DNA Test Cost? Dog DNA tests can cost you anywhere from around sixty to a few hundred dollars. The more expensive tests typically. Starting from only $ and with results in 3 weeks from receipt of samples at the laboratory, dog breed identification testing checks for 1, genetic markers. Same - for all 3 of the dogs I've had & tested! They cost a grand total of $ ($50, $, and free), while the tests were $ each. Price. $ Sale Price: $ $ Sale Price: $ ; Complete breed breakdown. Identification of + breeds. ; Genetic health concerns. Discover. Breed ID Test · $ · $ ; Breed + Health Test · $ · $ ; Breed + Health Test 2-pack · $ · $ ; Breed ID Test 2-pack · $ · $

How to do a Dog DNA Test. Ensure that your Dog DNA test results are accurate by watching a short video on how to take a Dog DNA sample. How to submit a. After the adoption we had to find out what her makeup was. We knew she was Lab but what else. So I started researching what makes up DNA testing, the process. The Basepaws Breed + Health Dog DNA Test provides everything a pet owner needs to understand their dog at an average price. The brand prioritizes early. A pet DNA test can cost anywhere from $$ depending on the depth of breed and health reports included. Here's a quick glance at the prices of some of the. Dog Test Prices ; One coat color/type test, $55 ; Two coat color/type tests (for the same animal), $75 ; Three coat color/type tests (for the same animal), $ A prepaid, barcoded AKC DNA Test Kit costs $50 (per dog). Previously, $50 non-prepaid DNA kits were also offered by AKC, but these kits will be phased out. Dog DNA Tests in Dog Health and Wellness(30) ; 29 · current price $ · 15 out of 5 Stars. 1 reviews ; 16 · current price $ ; 99 · current price $ · 44 out. Dog DNA Tests & Test Kits ; Wisdom Panel Essential Dog DNA Test Kit. (). $ was $ ; Wisdom Panel Premium Breed & Health. The scientists at Ancestry® will get to work using our cutting-edge DNA science to provide you with a full report on your best friend. $99*. Buy now*Excludes. Get to know your dog better with our great selection of dog breed, DNA, and health test kits for your furry friend. Our Top Tested Picks · Wisdom Panel Premium · Embark Dog DNA Test (Breed + Health Kit) · DNA My Dog Breed Identification Test. In the average cost of an at-home dog DNA test kit ranges from about $60 to $ These tests analyze specific genetic markers in your dog's DNA to help. The cost of dog DNA tests typically falls within the range of $ to $ Generally, higher-priced tests offer more comprehensive DNA analysis. However, we. Chewy has many different types of dog breed tests to choose from, so you should have no trouble finding one that offers all the features you. Why dog DNA testing? Know your dog. Better. At Embark, we're all about bringing humans and their dogs closer together. Learn more about what makes your dog. Canine Genetic Disorders and Coat Color Testing. Canine DNA Full TESTING KIT x1 Dog *Viaguard DNAffirm* Harmless Cheek Swab #Dog ; Approx. $ + $ shipping ; This one's trending. have already sold. How to do a Dog DNA Test. Ensure that your Dog DNA test results are accurate by watching a short video on how to take a Dog DNA sample. How to submit a. UNIQUE PERSONALITY TRAITS OF YOUR DOG: By using our DNA Test Kit, you can also get several genetic information of your pet's personality traits. You'll know how. Price. $ Sale Price: $ $ Sale Price: $ ; Complete breed breakdown. Identification of + breeds. ; Genetic health concerns. Discover.

Standard 500 Index

The current value of S&P Index is 5, USD — it has risen by % in the past 24 hours. Track the index more closely on the S&P Index chart. The ticker for the S&P index is ^GSPC, but it cannot be traded. SPX and SPY represent options on the S&P index, and they are traded in the market. Find the latest S&P (^GSPC) stock quote, history, news and other vital information to help you with your stock trading and investing. The Standard and Poor's , or simply the S&P , is a stock market index tracking the stock performance of of the largest companies listed on stock. S&P Index (INDEXSP INX) – ETF Tracker The index measures the performance of the large capitalization sector of the U.S. equity market and is considered. The S&P is a stock market index maintained by S&P Dow Jones Indices. It comprises common stocks which are issued by large-cap companies traded. Get S&P Index .SPX:INDEX) real-time stock quotes, news, price and financial information from CNBC. The index as it is known today was introduced in , when it was expanded to include. companies. “Standard & Poor's ” and “S&P ®” are trademarks of. The S&P is widely regarded as the best single gauge of large-cap US equities and serves as the foundation for a wide range of investment products. The current value of S&P Index is 5, USD — it has risen by % in the past 24 hours. Track the index more closely on the S&P Index chart. The ticker for the S&P index is ^GSPC, but it cannot be traded. SPX and SPY represent options on the S&P index, and they are traded in the market. Find the latest S&P (^GSPC) stock quote, history, news and other vital information to help you with your stock trading and investing. The Standard and Poor's , or simply the S&P , is a stock market index tracking the stock performance of of the largest companies listed on stock. S&P Index (INDEXSP INX) – ETF Tracker The index measures the performance of the large capitalization sector of the U.S. equity market and is considered. The S&P is a stock market index maintained by S&P Dow Jones Indices. It comprises common stocks which are issued by large-cap companies traded. Get S&P Index .SPX:INDEX) real-time stock quotes, news, price and financial information from CNBC. The index as it is known today was introduced in , when it was expanded to include. companies. “Standard & Poor's ” and “S&P ®” are trademarks of. The S&P is widely regarded as the best single gauge of large-cap US equities and serves as the foundation for a wide range of investment products.

The “S&P ® Index” is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and has been licensed for use by Standard Insurance Company. The New York Times is publishing the new Standard & Poor's Corporation index of common stock issues. It represents the prices of shares. Browse our S&P live chart to get all the information you need on the US price today. The S&P Index, also known as the Standard & Poor's or the. The Standard & Poor's Index is a capitalization-weighted index of stocks from a broad range of industries. The component stocks are weighted. The Standard and Poor's , or simply the S&P , is a stock market index tracking the stock performance of of the largest companies listed on stock. The fund invests at least 90% of its assets in the securities of issuers included in the S&P ® Index. It may invest in stock index futures as a substitute. Custom Indexing · Crypto · US Inflation · Mortgage Rates · Treasury Rates. S&P ETF Components. List shows the holdings of the SPDR S&P ETF Trust (SPY). View data of the S&P , an index of the stocks of leading companies in the US economy, which provides a gauge of the U.S. equity market. The S&P 1 Year Return is the investment return received for a 1 year period, excluding dividends, when holding the S&P index. The S&P index is a. Standard and Poor's (S&P Index) → The S&P index, to reiterate from earlier, uses a market capitalization-weighted approach, where the mechanism to. It is a market value weighted index made up of the prices of large stocks traded in the US market. S&P Index ; YTD Change. % ; 12 Month Change. % ; Day Range5, - 5, ; 52 Wk Range4, - 5, ; Total Components S&P Key Figures ; Performance, %, % ; High, 5,, 5, ; Low, 5,, 5, ; Volatility, , View the full S&P Index (SPX) index overview including the latest stock market news, data and trading information. The S&P ® Value measures constituents from the S&P that are classified as value stocks based on three factors: the ratios of book value, earnings and. The Standard & Poor's , or S&P .SPX), is an index made up of top American companies and is an indicator of how the US stock market is performing. Find the latest S&P INDEX (^SPX) stock quote, history, news and other vital information to help you with your stock trading and investing. Trending Indexes ; COMP. Nasdaq Composite Index. 16, ; NDX. Nasdaq 18, ; SPX. S&P 5, ; INDU. Dow Industrials. Interactive chart of the S&P stock market index since Historical data is inflation-adjusted using the headline CPI and each data point represents the. The Mini-SPX Index is based on 1/10th the value of the Standard and Poor's Index. Calculation reflects a relationship of 1 SPX = 10 XSP. Calculate. Reset.

How Do I Trade Etfs

ETFs are "exchange-traded" and can be bought or sold intraday at different prices. Mutual fund trades are executed once a day, at a single price. Instead of diversifying your portfolio with individual stocks, you can cover entire sectors with ETF. Get the best possible price execution on your ETF. If you want to start ETFs trading using CFDs, sign up for an account with a CFD provider like rusabc.ru You can trade ETF CFDs along with CFDs of commodities. THREE WAYS TO TRADE iSHARES ETFs · Fidelity Investments. At Fidelity, you can start with as little as $1 when you buy fractional shares of iShares ETFs. Exchange Traded Funds · Performance · BrandywineGLOBAL - U.S. Fixed Income ETF - USFI · BrandywineGLOBAL-Dynamic US Large Cap Value ETF - DVAL · ClearBridge. When you place a market order, you're telling your broker you want to trade an ETF right now—at whatever price it takes to attract shares. If the market is. Exchange traded funds (ETFs) combine diversification, low costs, and real-time market pricing. Learn about your ETF investing options at Vanguard. The market maker gives the AP the bouquets, who then brings them to the iShares workshop where they are disassembled into individual flowers. And just like that. ETFs or "exchange-traded funds" are exactly as the name implies: funds that trade on exchanges, generally tracking a specific index. When you invest in an. ETFs are "exchange-traded" and can be bought or sold intraday at different prices. Mutual fund trades are executed once a day, at a single price. Instead of diversifying your portfolio with individual stocks, you can cover entire sectors with ETF. Get the best possible price execution on your ETF. If you want to start ETFs trading using CFDs, sign up for an account with a CFD provider like rusabc.ru You can trade ETF CFDs along with CFDs of commodities. THREE WAYS TO TRADE iSHARES ETFs · Fidelity Investments. At Fidelity, you can start with as little as $1 when you buy fractional shares of iShares ETFs. Exchange Traded Funds · Performance · BrandywineGLOBAL - U.S. Fixed Income ETF - USFI · BrandywineGLOBAL-Dynamic US Large Cap Value ETF - DVAL · ClearBridge. When you place a market order, you're telling your broker you want to trade an ETF right now—at whatever price it takes to attract shares. If the market is. Exchange traded funds (ETFs) combine diversification, low costs, and real-time market pricing. Learn about your ETF investing options at Vanguard. The market maker gives the AP the bouquets, who then brings them to the iShares workshop where they are disassembled into individual flowers. And just like that. ETFs or "exchange-traded funds" are exactly as the name implies: funds that trade on exchanges, generally tracking a specific index. When you invest in an.

Buy and Sell ETF Shares Commission-Free. Buying and selling shares in ETFs with tastytrade is commission-free, no matter the number of shares.1 When trading. ETFs (exchange-traded funds) are a great way to add diversification to your portfolio. E*TRADE lets you trade every ETF sold, plus over commission-free. An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product, i.e., it is traded on stock exchanges. ETFs own financial. ETFs offer investors the ability to trade throughout the day, in addition to lower management fees and tax advantages over many mutual funds. 7 Best ETF Trading Strategies for Beginners · 1. Dollar-Cost Averaging · 2. Asset Allocation · 3. Swing Trading · 4. Sector Rotation · 5. Short Selling · 6. You set a stop price and your ETF is automatically sold if its bid price falls through that level. The price you get is the best available current price. An exchange-traded fund (ETF) is a collection of investments such as equities or bonds. ETFs will let you invest in a large number of securities at once, and. ETFs don't have minimum investment requirements -- at least not in the same sense that mutual funds do. However, ETFs trade on a per-share basis, so unless your. Exchange-traded funds (ETFs) are SEC-registered investment companies that offer investors a way to pool their money in a fund that invests in stocks, bonds. An exchange-traded fund (ETF) is a collection of investments such as equities or bonds. ETFs will let you invest in a large number of securities at once, and. ETFs are bought and sold on a stock exchange – in much the same way as stocks. They perform a similar function to indices, investment trusts and other exchange. Step-by-step guide · 1. Select the account you want to trade in. · 2. Enter the trading symbol. · 3. Select Buy or Sell. · 4. Choose between Dollars and Shares. These newly created ETF shares are then introduced to the secondary market, where they are traded between buyers and sellers through the exchange. When demand. Unlike mutual funds, however, ETF shares are traded on a national stock exchange and at market prices that may or may not be the same as the net asset value. (“. What are the Best Practices for Trading ETFs? · 1. Use Limit Orders. Use limit orders when buying or selling ETFs. · 2. Know Your Market. Be mindful of volatile. Open your account online. Get started. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services (we offer them commission-free online) or. Exchange traded funds (ETFs) are a type of security that combines the flexibility of stocks with the diversification of mutual funds. The exchange traded. Exchange traded funds (ETFs) Exchange traded funds (ETFs) are a low-cost way to earn a return similar to an index or a commodity. They can also help to. When the bid-ask spread is wide, a limit order can help with pricing an ETF. For an ETF buyer, the limit buy order is only executed if the ETF falls below a. You set a stop price and your ETF is automatically sold if its bid price falls through that level. The price you get is the best available current price.